Over 1,400 companies have chosen innoscripta to safeguard their R&D investments.

Built on years of experience with R&D tax incentive projects and subsidy application

We have been helping companies all over the world since 2012 to successfully apply for subsidies to enable them to do what they do best. Our software supports you in the most optimal way in any scenario.

Identifying All Your R&D Projects

We ensure you capitalize on every opportunity to maximize your tax credit claims.

Writing Grant Applications

Benefit from our proven track record of 4000 research projects in formulating winning R&D tax credit applications.

Streamlining R&D Efficiency w/ Clusterix

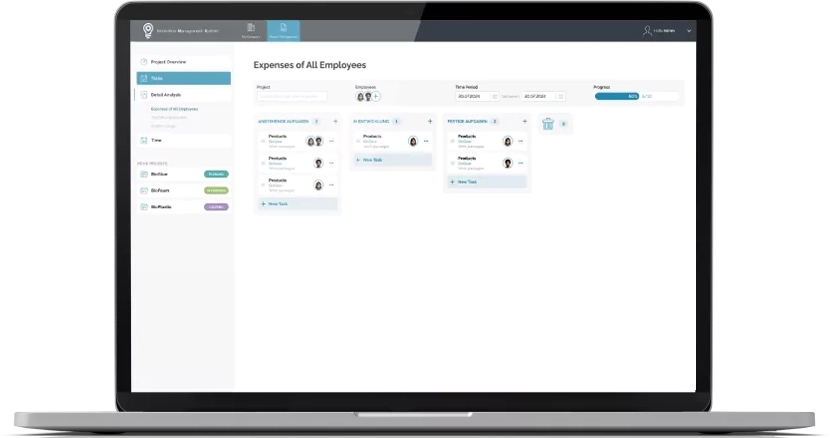

Centralize all your documentation into our software for managing the project, timesheets, and compliance all in one place.

Comprehensive Support for Tax Incentives Funding

We are committed to maximizing your business potential through R&D tax incentives. Our expert team guides you from the initial assessment to the final submission, ensuring compliance and maximizing benefits. We provide personalized support to simplify complex tax scenarios into successful claims.

Project Setup & Training

Project planning & application

Documentation & Time Tracking

Submission & Archiving

Wondering if you're eligible for a tax research refund? Schedule your free consultation now!

Audit-Proof R&D Compliance with innoscripta

Our innovative software solution handles every detail of your R&D activities, from documentation to compliance, ensuring a seamless, transparent, and highly efficient R&D management experience.

Structure your R&D projects with our project planning tool so that you can better track the project progress and the use of your resources and document your activities in a legally compliant manner. Work packages with concrete development content and goals as well as a time and personnel framework are defined for each project and specific R&D employees are assigned.

Trust in one of the largest specialist of innovation funding in Germany

Don’t put your R&D subsidies at risk and prevent legal processes. We support our customers to have audit-proof documentation at the click of a button. Sign up for a free consultation now.

Maximize Your Funding

Maximize reimbursement rate from tax authorities

Fast Funding Delivery

Faster application processes through AI-based software

Secured Funding Assurance

90% approval rate of funding applications

Compliance and Security

Legal security during R&D audits

More than 1,400 companies have already placed their trust in innoscripta!

Arrange a free consultation now

Complete our form, and within 15 minutes, we'll determine if your company is eligible for tax research funding!

Jeff Scriba

Partner | Teamlead B2B Sales & Innovation Consulting